Digital chamas and micro-finance empower African women’s independence

By Brian Ochieng Akoko, Reporter | Nakuru City – Kenya.

Access to capital is the single greatest barrier to economic growth in Africa. For women entrepreneurs, this barrier is often compounded. It is intensified by cultural norms and institutional bias.

Traditional banking systems often demand collateral. This collateral is typically land or property, which few women legally own. Yet, African women are the engines of the continent’s informal and small business economy. They are driving grassroots commerce.

In response to this systemic exclusion, a parallel financial system has thrived. It is based on trust, community, and solidarity. This system is comprised of micro-finance institutions (MFIs) and traditional savings and credit cooperative groups (SACCOs).

Most importantly, it is powered by localized savings groups, often known as chamas (in Kenya) or similar terms across the continent. These groups are transforming the lives of millions.

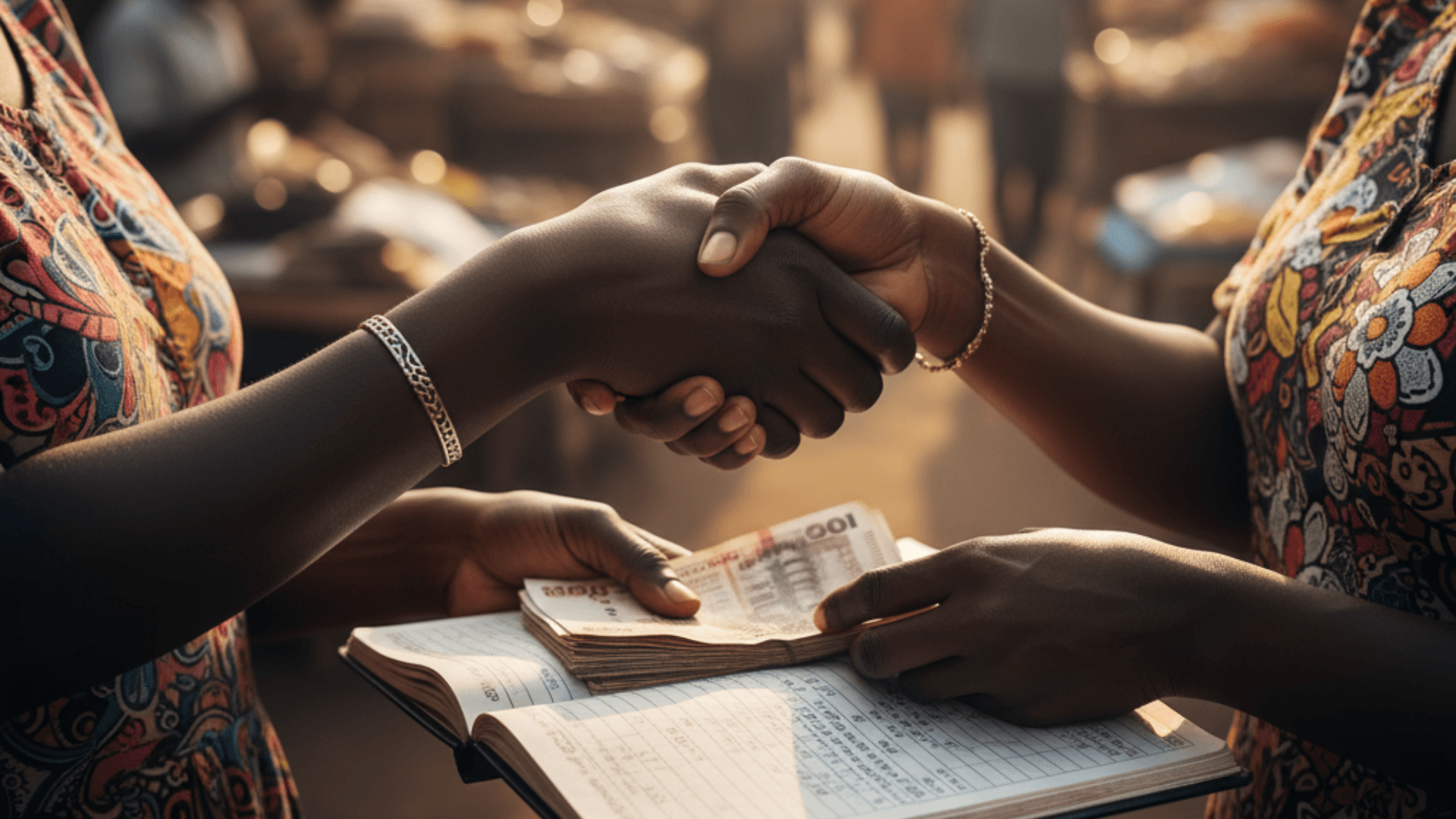

They are providing the essential capital that formal banks deny. This is the power of a handshake. It is a financial revolution built on community trust and mutual support. It is a profound story of economic resilience and empowerment.

The Chama Model: Trust as Currency

The chama model is ancient. It is based on rotational savings and lending. A group of women, often neighbours or colleagues, agree to contribute a fixed amount of money weekly or monthly.

The entire sum is then given to one member on a rotational basis. This lump sum allows them to fund a business venture or pay for a major expense. This model is inherently inclusive.

It requires no collateral beyond the member’s reputation and commitment to the group. Trust is the currency. The groups also provide informal financial literacy training. They offer emotional support and shared business advice.

In the digital age, these chamas are evolving. They are moving onto mobile money platforms. Mobile platforms like M-Pesa allow for easy collection, distribution, and tracking of funds.

This adds transparency and efficiency. Digital chamas can grow larger and operate faster. They can connect women who are geographically distant. This evolution is making the traditional system more robust.

It is increasing the capital available for investment. The money generated by these groups is crucial. It funds market stalls, small-scale farming equipment, and home-based services.

This capital injection is vital. It creates sustainable livelihoods and improves household stability dramatically.

The Role of Micro-Finance Institutions (MFIs)

Micro-finance institutions (MFIs) complement the grassroots savings groups. MFIs provide slightly larger loans. They often target registered women’s co-operatives. Their lending models are unconventional.

MiThey prioritize character and business plans over traditional collateral. Many MFIs offer group lending programs. The entire group co-signs the loan. This reduces the risk for the MFI.

It also creates peer pressure for timely repayment among the borrowers. The repayment rates in these women-led groups are often exceptionally high. They surpass those of traditional commercial loans.

This high success rate proves the financial viability of lending to female entrepreneurs. It is a powerful rebuttal to traditional banking skepticism. MFIs also provide specialized training in business management. They offer market linkages and technical assistance.

This support helps women entrepreneurs move from the informal sector to formalized, registered businesses. The impact is holistic. It provides not just the money, but the skills and confidence to succeed.

Micro-finance is a tool for empowerment. It gives women the power to decide their own economic future. It challenges the patriarchal structures that often limit women’s economic mobility.

Redefining Household Stability and Social Status

Financial independence profoundly changes a woman’s social status. When a woman controls the income, the household stability increases. This is a proven development metric.

Women tend to invest their income in specific areas: child education, health, and nutrition. This makes micro-finance a powerful engine for achieving Sustainable Development Goals (SDGs) at the family level.

The children of women entrepreneurs are more likely to stay in school. They are more likely to be healthier. The ability to access credit and manage money builds self-confidence. It gives women a stronger voice in family and community decisions.

This is a quiet, yet profound, transformation of gender dynamics. It is happening across villages and towns. The success stories are numerous and inspiring. A woman who started with a small chama loan to buy two chickens.

She now owns a thriving poultry farm. She employs three staff. She sends her children to university. These are not isolated incidents. They are the pattern of grassroots economic growth. The power of micro-finance lies in its simplicity.

It is an investment in human potential, backed by the strength of community trust. It is a powerful reminder that the best solutions often arise from the people who face the problems.

Daj svoj stav!

Još nema komentara. Napiši prvi.